What next for Hotel Chocolat after its sweet £534m deal with Mars?

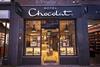

Even for a business that deals in confectionery, the announcement this morning that Hotel Chocolat’s board had accepted a £534m acquisition offer from multinational conglomerate Mars has come as a sweet surprise.

The business, which has 125 stores in the UK and 21 in Japan, plus a luxury hotel on its cacao farm on the Caribbean island of St Lucia, had been going from strength to strength during the pandemic.

Already have an account? Sign in here