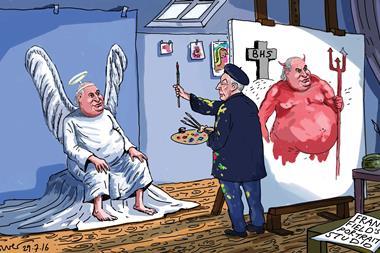

“We don’t doubt that Sir Philip had some affection for BHS – to an extent it created him. Now it could also bring him down.”

That was one of the less brutal comments in the report from MPs into BHS following its collapse into administration.

There was not the slightest doubt in the MPs’ minds about who should be held accountable for BHS’s ignominious end after 88 years on the high street: Sir Philip Green.

However, while Sir Philip was judged “ultimately responsible for the BHS disaster”, the report – a serious, thorough document drawing upon a wide variety of evidence – highlighted dreadful failures on the part of almost everyone involved in the sorry saga.

“Forceful personalities such as Sir Philip and Mike Ashley didn’t get where they are by running things by committee. However, had better, stronger governance been in place perhaps they would not have found themselves in the position they do today”

George MacDonald

Perhaps the biggest takeaway, one also prominent in last week’s similar parliamentary report into employment practices at Sports Direct, is how important effective corporate governance is.

Driven, forceful personalities such as Sir Philip and Sports Direct founder Mike Ashley didn’t get where they are by running things by committee.

However, had better, stronger governance been in place perhaps they would not have found themselves in the position they do today because decisions and ways of doing things would have been properly challenged.

Concern has been expressed about whether Sports Direct chairman Keith Hellawell is up to the role. Sir Philip’s Taveta group board chairman Lord Grabiner’s performance was described in the BHS report as “complacent” and “the apogee of weak corporate governance”.

Reputational damage

The need to improve governance standards, at privately held businesses in particular, was one of the main messages to come out of the BHS report, and the possibility of further regulation to make that happen was raised.

This week’s headlines will have made sobering reading for Sir Philip, and all the others involved – from the “incompetent and self-serving” Dominic Chappell to some of the biggest names in the City such as Goldman Sachs.

But those who have really suffered from the collapse of BHS are the 11,000 people now or soon to be out of work, and the 20,000 pensioners whose retirement savings are now in jeopardy.

Sir Philip’s career has been characterised by audacious deals. It has also often been characterised by generosity, such as his support for industry charity Retail Trust and the Fashion Retail Academy.

Now is the time for him to make the greatest play of his career, combining his financing flair with magnanimity, to the advantage of BHS pensioners.

He has said he can ‘fix’ the pension problems. No doubt he is working behind the scenes to find a solution.

The sooner he does so the better, for the good of his own reputation and that of the wider retail industry.

3 Readers' comments