With online becoming an integral part of retail, and pureplay competition rife, investing in the right digital capabilities is crucial for success. Nowhere is this truer than for department stores, a sector that relies heavily on footfall.

The sector consists of only nine retailers, but is quite segmented. Middle-market players Marks & Spencer and John Lewis have committed to focus on ‘differentiation’ over store expansion because of various pressures.

M&S – Indicator’s leading department store – is cutting costs and planning to reduce its store estate, while John Lewis is sacrificing short-term profit to invest in a long-term transformation plan.

Meanwhile, more-premium giants Harrods and Selfridges have maintained financial health through their unique propositions, brand heritage and international demand, despite having catching up to do when it comes to cross-channel and logistics capabilities.

At a time when department stores are struggling to remain relevant and suffering at the hands of pureplays, it is more important than ever for the sector to continually adjust to the digital economy to remain competitive.

The struggles of the department store are clear to see at House of Fraser. While it reached third place in Indicator’s department store ranking, it’s currently undergoing a company voluntary arrangement resulting in the planned closure of over half of its stores.

Despite having many fundamental capabilities which enhance the customer’s digital journey today – including a push on personalisation and some favourable delivery options – the business as a whole has suffered from a chronic lack of investment, and it has to be remembered that a compelling digital offer is only part of the puzzle, especially with the overheads that come with supporting an expensive store estate.

Cross-channel

John Lewis is the second-placed department store in our Indicator ranking and perhaps the most innovative in terms of merging its online and offline channels.

Its recently unveiled 10-year strategy revealed aggressive investment plans aimed at improving areas such as personalisation in-store. It offers both third-party click and collect and returns services, as does House of Fraser, and also leverages Waitrose’s store network to boost online orders.

Click and collect to stores is offered by 78% of department store retailers.

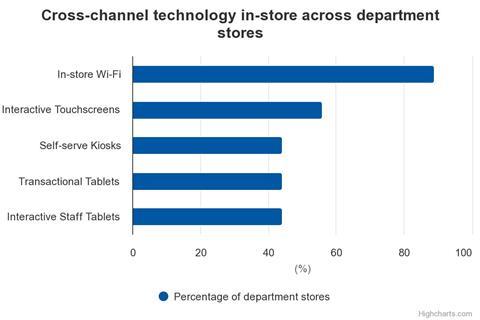

Like John Lewis, M&S has in-store Wi-Fi, interactive touchscreens, self-serve kiosks, and interactive staff tablets. This creates an immersive in-store journey and supports a truly omnichannel experience by improving stock visibility.

However, there are cross-channel functions that department stores have failed to invest in. None of them offer reserve-online-pay-in-store functions, perhaps missing an opportunity to leverage their theatrical, immersive stores for upselling opportunities. This could be particularly suitable for Fenwick as it has no transactional website.

Harrods is the only retailer to offer interactive in-store app navigation, a tool that guides shoppers through its vast Knightsbridge store, supporting convenience and adding to the feel of destination retail.

Similarly, Selfridges is developing an interactive version of its in-store navigation tool on its app, building on its current store guide that offers a detailed A to Z and map of the store’s services and departments.

Logistics and customer service

Superior customer service was once synonymous with the department store sector but it has fallen behind the times. Indicator found the sector has relatively slow email and social media response times – with the latter growing in importance for customers – while only a fifth of department stores offer live chat online, demonstrating a lack of innovation.

Several department stores have, however, made good use of their British credentials and logistics capabilities to appeal to overseas customers. All bar Fenwick offer international delivery.

Department stores are also expanding their payment options to support rising international demand. Selfridges was the first to launch a means of payment for Chinese customers with China UnionPay in 2006. It has since extended its capabilities to accept Alibaba’s Alipay digital payments.

Realising the importance of convenience, M&S, John Lewis and Selfridges are at the forefront, each offering time-slot and named-day delivery.

House of Fraser offers same-day delivery, an enviable capability but one that is more in demand across sectors like general merchandise and grocery. However, speed and convenience of delivery should remain central for the allure of department stores when competing against multiple sector specialists – such as pureplay and fashion giant Asos.

Ecommerce

According to Indicator, the department store sector has some of the slowest product page download speeds across mobile and desktop, nearing six seconds for both on average – this is nearly two seconds slower than health and beauty and fashion retailers, on average.

Website download speed is often a fundamental element in preventing customers from leaving the site and looking elsewhere. This is especially important for department stores given the sector’s wide-branded product offering, which can likely be found somewhere else too.

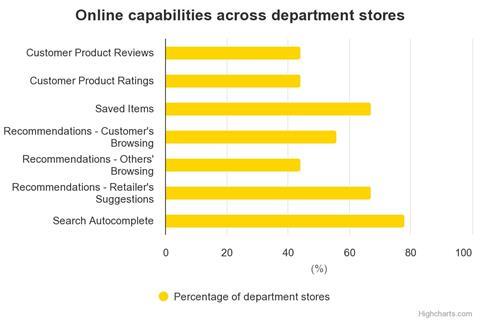

It also has the lowest proportion of retailers offering customer product reviews and ratings, at only 44%, while none provide product videos.

While most department stores are heavily reliant on footfall, which has driven investment towards in-store experiences to eliminate the issue of non-profitable space, it is illogical for any retailer these days not to invest in ecommerce capabilities.

In the sector, the online channel is still vital for supporting engagement and boosting growth rates.

M&S is prioritising online growth as it reduces store numbers and invests in website responsiveness. It has the fastest product page download speed in the sector on desktop and is upgrading its search capabilities to make it easier and faster for customers to find the products they want.

However, M&S still faces intense competition in the increasingly disrupted food market. Investing in features like product comparisons could help it differentiate and highlight the quality and breadth of its range to a greater advantage. John Lewis is the only department store currently using product comparisons.

Marketing

M&S is a marketing leader in the sector, with customer analysis from its Sparks loyalty scheme showing that members shop more frequently with the retailer and across more product categories.

In turn, M&S uses Sparks’ data to personalise marketing communications, allowing it to enhance the customer experience and garner loyalty and retention.

Overall, 89% of department stores have a loyalty programme compared to just 29% of UK retailers, reflecting their importance to the sector. However, only 50% of those in the sector with loyalty schemes have made these accessible through apps – instigating a more seamless experience in store.

Department stores tend to appeal to a wide range of demographics, so marketing activities per product division need to be tailored to segmented customers within their larger audiences.

For instance, Debenhams’ Beauty Club is focused around its most regularly shopped categories and more frequent female shoppers, in line with its more value-oriented proposition. The Beauty Club’s tiered points system sees members earn points for purchases as well as offering free beauty treatments and delivery. This adds a more personalised touch that is increasingly key to growth as brand loyalty fades.

Retail Week Indicator 2018 rankings

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

Currently reading

Currently readingRetail Week Indicator 2018: Are department stores reinventing fast enough?

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26