The clothing sector has taken a battering in recent years. Profit margins have come under pressure as retailers continue to be hit by currency volatility and continuous discounting, while sales are falling for many as customer loyalty diminishes.

Technology has polarised the sector, enabling shoppers to be more savvy and price focused.

Online entrants, such as Boohoo, and discount chains, led by Primark, are taking an increasing share of sales at the expense of the middle market.

The high street’s almost perpetual promotions have worked in favour of value-led online retailers as customers have become accustomed to low prices, while luxury fashion continues to appeal to more affluent shoppers.

Clothes shopping is often seen as a leisure activity, which has created an acute shift towards retailers offering in-store experiences.

This plays in favour of new developments in technology offering new ways to engage with shoppers.

But with the new generation of shoppers armed with smartphones, appearing on-trend on social media has never mattered more, as well as forgoing being seen in the same outfit twice. This has put immense pressure on lead times and generated a buy-now-wear-now approach, with the likes of Boohoo, Missguided and Asos being able to turn around new lines in a matter of weeks, and requires fresh approaches to manufacturing and sourcing.

Cross-channel

Fashion retailers do not need extensive store estates to offer a competitive cross-channel proposition.

Online retailers such as Shop Direct, Boohoo and Missguided have bridged the online/offline divide by using third-party logistics suppliers such as CollectPlus, Doddle and DPD to offer click-and-collect delivery and convenient returns at local collection points.

Pureplays are also leveraging multichannel retailers’ estates for collection points. For example, Missguided has partnered with Asda to take advantage of the grocer’s toyou collect and return points.

But for those with a physical presence, stores must be used to offer a connected experience across the online and offline channels to remain relevant in the next decade.

With a few exceptions, such as All Saints and Charles Tyrwhitt, click and collect is available across most bricks-and-mortar fashion retailers, though Sports Direct is yet to permit online returns to store. It is surprising that not all retailers with stores are leveraging geolocation to help shoppers find stores more easily, with only 69% of multichannel fashion players enabling this feature.

It is also staggering that reserve online and pay in-store is only offered by footwear retailer Schuh. The new generation of shoppers are impatient but want guarantee. Reserve and collect offers a foray of advantages for the customer and retailer; while driving footfall to stores with upselling opportunities, customers are given more freedom in purchase decisions before parting with their cash and offered stock guarantee to avoid disappointment.

However, reserve and collect is not simple to operate as retailers need a single view of stock, and there is the risk of uncollected orders.

Visibility of store stock online is becoming increasingly critical to drive consumers to physical shops, but also for the retailer to keep track of fast moving lines. But only 28% in the sector provide such a capability. River Island is an exception; it has introduced RFID technology from Byways to track store stock more fluidly.

Ecommerce

Despite its obvious limitation – the fact shoppers cannot always try before they buy – ecommerce is ingrained in fashion retail.

The most advanced retailers are investing heavily in online features to combat this.

LK Bennett partnered with Amplience to produce catwalk videos and 360-degree views so shoppers could better visualise its products.

Across the sector the average number of product images used online is surprisingly low, behind electricals and home and DIY, at only four images per product.

Dune believes the more images a customer can view, the more likely they are to buy a product. This has driven the footwear specialist to offer nine images on average per product – the highest amount across the 180 UK retailers that Indicator reviewed.

Product recommendations are particularly useful for retailers with a broad range to ensure customers can see the wider offer. However, less than two-thirds are making use of customer data effectively by providing recommendations based on a customer’s browsing or purchase history.

Customer reviews can also drive sales but are not considered appropriate by all segments of the market. Luxury retailers have largely steered clear of customer reviews, preferring to maintain an exclusive feel in a market where the products do the talking.

No retailer in the sector offers product comparison online. This contrasts with the in-store experience, where shoppers will often try on a few items in a changing room at one time and compare styles and materials side by side.

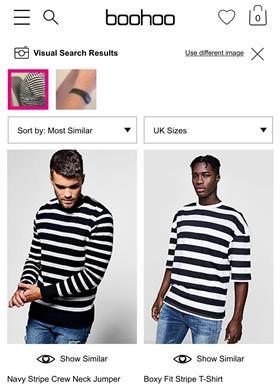

In such a visual category, image search, which allows shoppers to use photos of items they like to find similar products within a retailer’s range, is set to rise as they demand frictionless experiences. Just four fashion retailers offer image search on their apps – H&M, Asos, Urban Outfitters and Zalando – while Boohoo has implemented it on its mobile site.

Logistics and customer service

With the exception of Primark’s stridently physical approach to fashion retail, having convenient delivery and return propositions are key differentiators in the intensely competitive fashion sector.

Returns are widespread in fashion, but weigh on profitability, especially as free returns have become an expectation – offered by 69% of the sector. Customers want to be able to try on and return clothes and footwear freely. As such, the cost of returns tends to be absorbed by the retailer.

However, new technology initiatives can limit the rate of expensive returns. Asos is trialling augmented reality to show products on different size models, so customers can get a better sense of what items look like on different body types, reducing the likelihood of it not fitting.

When it comes to delivery, subscription services are now being used to drive loyalty. Reflecting the frequency of shop among its customers, the likes of Boohoo and Missguided offer unlimited next-day delivery through a yearly subscription service to create stickiness, providing a reason to shop with them over the competition. These sorts of capabilities are seeing emerging players take market share from more traditional retailers.

Guarantee in delivery is also of growing importance, however, only 37% of fashion retailers offer named day delivery and a handful offer time slot.

In a buy-now-wear-now culture, speed in delivery is key. Same-day delivery is offered by 12% in the sector, but it is costly and likely to only remain viable at the luxury end, with giants like Asos, JD Sports and Zara being the exception rather than the rule.

Particularly important for fashion players is the revival of buy-now-pay-later schemes, a model popular among catalogue shoppers for decades.

Retailers that partner with payment services such as Klarna can offer more flexibility for shoppers – while, critically, also giving customers a chance to try on purchases before paying. However, just under a fifth in the sector offer the service.

Marketing

Rather than traditional advertising, fashion retailers are investing heavily in digitally driven, above-the-line methods to drive brand awareness, particularly on social media.

This channel is key when targeting the new generation of shoppers. Most retailers in the sector create aspirational digital content to drive engagement, while many incorporate shoppers’ external interests when promoting products and to raise brand recognition. For example, many fashion retailers will leverage interest in TV shows such as Love Island in their own campaigns.

Clothing retailers have some of the highest social media followings, with the likes Zara and H&M exceeding 50 million followers.

Another source of inspiration for shoppers comes through search engines. Nearly 90% of fashion retailers list products on Google Shopping – removing another layer of friction for customers when browsing.

Retail Week Indicator 2018 rankings

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

Currently reading

Currently readingRetail Week Indicator 2018: The pureplays redefining fashion

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26