In the general merchandise sector, there is a pronounced dichotomy between retailers with digitally advanced offers and more traditional ones at that rely on bricks-and-mortar stores.

But across the board, retailers have adopted customer-facing capabilities to varying degrees of success.

Amazon, Indicator’s leader in the general merchandise sector, has set new standards for frictionless shopping experiences despite having no physical presence in the UK.

Meanwhile, Argos – placed in second – has taken advantage of its store estate to bridge the gap between the online and offline channels, as one of the first to offer same-day delivery and click and collect.

Using technology partnerships is increasingly key to growth for those without Amazon’s resources. This is illustrated by Hobbycraft’s partnership with e-Global to launch of a dedicated international platform, which has supported its burgeoning overseas proposition.

Ecommerce

The sector has the lowest proportion of retailers with transactional websites (79%), illustrating the challenges associated with selling low-value products online

At one end of the spectrum, Amazon is an ecommerce behemoth, providing a convenient and seamless customer journey across desktop and mobile websites, as well as its mobile app. Using capabilities like robust product recommendations and customer ratings and reviews supports average order values and dwell time.

At the other end are the likes of Home Bargains, whose website accounts for a low percentage of its overall sales and is considered as more of a promotional tool. Its underdeveloped ecommerce capabilities and lack of investment online prohibit opportunities to offer complimentary bundles or promote higher-margin products.

Only half of general merchandisers provide recommendations based on a customer’s browsing and purchase history – forgoing a pivotal upselling tool.

Like Amazon, eBay is a marketplace that thrives on customer data. Its personalised homepage encourages shoppers to pick up where they left off, offering gentle prompts to retarget conversion.

eBay’s targeted approach is also supported by requiring users to register before purchasing, ensuring customer behaviour can be tracked easily.

However, eight retailers in the sector offer guest checkout. Changing this should be a priority for the likes of Hobbycraft and Wilko, which are missing out on valuable customer data.

Cross-channel

Argos is the leading multichannel retailer in the general merchandise sector, with a strongly aligned digital and physical proposition. It is the only general merchandiser that lets customers reserve items online then pay in-store. It also offers home delivery for in-store purchases, supporting a seamless and connected shopping journey across channels.

It is now able to leverage Sainsbury’s estate to further grow click-and-collect purchases and extend its appeal.

In-store innovation is scarce across the sector but Argos has invested in interactive in-store touchscreens, beacons and app-based geolocation – facilitating an immersive experience for the customer.

As many in the sector are heavily reliant on store sales, retailers would benefit from in-store environments that support data gathering and dwell time.

For instance, B&M uses its app to improve the in-store journey, despite operating no transactional site. It lets consumers scan the barcode of products in-store to find out more information, such as price comparisons and discounting activity, supporting its value-led appeal and illustrating the potential of online investments in driving in-store sales.

Personalisation is central to Paperchase’s proposition. Customers can set reminders to purchase cards and gifts for special occasions on its website, driving spend online or in-store. It also offers click and collect to stores and via third parties in partnership with CollectPlus – with the latter used by only a quarter of general merchandisers.

Logistics and customer service

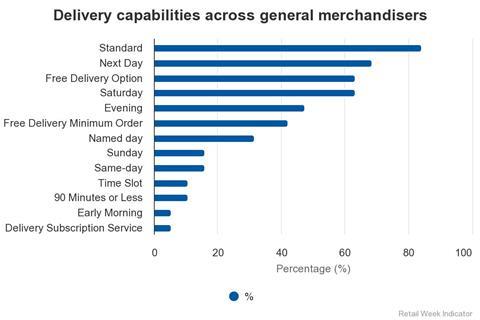

While Amazon and Argos thrive on the strength of their fulfilment offers, many general merchandisers have failed to up their game.

Delivery partnerships are therefore becoming increasingly valuable. eBay’s tie-up with Argos allows sellers to drop off eBay packages, which Argos then delivers to a shopper’s home using its distribution network, making fast home delivery cheaper.

eBay and Amazon both offer delivery in 90 minutes or less, Sunday delivery, free returns and named-day delivery. Such convenience is now ingrained in the consumer psyche and this is where several general merchandisers fall down.

| Amazon in numbers | |

|---|---|

| Average email response time | 5 hours |

| Average social media response time |

22 minutes |

| Average number of product images | 7 |

| Number of communication channels | 5 |

| Number of social media followers | 67,700,000 |

For instance, Notonthehighstreet has substandard fulfilment options despite being a gifting specialist whose customers often require guaranteed time-specific delivery for special occasions.

In contrast, Paperchase has embraced consumer expectations, being the only retailer to offer early-morning delivery via its partnership with Yodel, on top of offering evening and named-day deliveries. Such a robust fulfilment offer requires it to charge a minimum delivery fee but its affluent customer base ensures its model remains viable.

Paperchase’s strategy also highlights the advantages of supply chain collaborations, which are underused in the sector. It has partnered with iForce for its Route Genie software, with track-and-trace functionality across all orders – regardless of which carrier is fulfilling the delivery. The technology allows Paperchase to provide shoppers with full visibility of all deliveries and sends customised messages at chosen points along the delivery process. This is another key differentiator in a sector where customer service capabilities are also uninspired.

Only 37% of general merchandisers have invested in live chat functions online, while response times on social media are among some of the slowest in Indicator’s study – averaging just over seven hours for the sector.

Marketing

Personalisation is a key investment area for several general merchandisers.

Loyalty schemes boost the volume of customer data that can be obtained, as well as helping retailers to acquire a single view of the customer – enabling more personalised engagement and tailored offers. However, only five retailers in the sector offer loyalty schemes.

Pets at Home is the only general merchandiser with a loyalty app. It recently digitised its Very Important Pets loyalty scheme with an app that enables push notifications, allowing it to promote offers in real time and helping it retain its dedicated customer base of animal lovers.

This could be food for thought among other general merchandisers, as less than half have mobile apps.

Despite general merchandisers being more reticent than other retail sectors to launch online, the sector attracts the highest volume of traffic through natural search – 92.5% on average.

Retail Week Indicator 2018 rankings

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

Currently reading

Currently readingRetail Week Indicator 2018: The digital dichotomy in general merchandise