The health and beauty sector has performed resiliently in the face of increasingly difficult trading conditions over the past few years.

The essential nature of many health and cosmetics items protects the market to a certain degree from reduced discretionary spending. But volume growth is being driven by product innovation and new ingredients, spurred on by increased consumer interest propelled by the rise of social media.

Growth in the sector has also been supported by a rising interest in men’s grooming, which has generated a new wave of spending, as well as the growing wellbeing and fitness trend.

While stores are still the main purchase channel, spend continues to shift online. Investment in digital operations by pureplay specialists like Feelunique, and market leaders including Boots and Superdrug, has boosted spending online, especially as demand for convenience is targeted via click-and-collect services and same-day delivery.

However, with an influx of new players trading in the sector as non-specialists look for additional avenues to grow revenues – including Asos and Primark – specialists are likely to see an effect on their market share as a result of increased competition.

It is imperative for health and beauty retailers to continually innovate – in terms of product and customer experience – to protect market share and drive loyalty.

Cross-channel

Boots’ cross-channel fulfilment capabilities help distinguish it from the rest of the pack. It leverages its vast store estate to support click-and-collect orders, which are free for all order values – a rarity in the sector. With 90% of the UK population within a 10-minute drive of a Boots store, the majority of its online orders are picked up from a store, offering plenty of upselling opportunities once the customer comes in.

This is a massive advantage on pureplay retailers in the sector, which are yet to fully exploit collection and returns via third parties to bridge the gap between online and offline channels.

Only 50% of the sector use third parties for click-and-collect deliveries, with Feelunique the only pureplay retailer in the sector to use this service for returns too.

Holland & Barrett is one of the latest retailers to enable customers to shop from their full range in-store, in which staff can place orders through their till points, which it describes as “the final part of the omnichannel experience”. Orders placed in-store can be fulfilled through click and collect or home delivery.

For those with a physical presence, there are several technologies like Wi-Fi, interactive touchscreens and tablets, which provide a more connected in-store customer experience and differentiate them from the rest of the sector.

Boots is the only retailer in the sector offering self-service kiosks, reducing queuing times and supporting convenience. Store staff are also armed with iPads fitted with its Sales Assist app to give staff access to real-time stock availability online and in-store – offering a superior service to rival Superdrug.

Marketing

When it comes to marketing, traditional multichannel retailers have outshone the digital upstarts.

Superdrug’s tie-up with TV hit Love Island for the past three years has helped it tap into its key demographic of 16-34-year-olds. Product placement and adverts across television and social media platforms helped deliver sales growth in key departments. Sun care sales soared 112% during the latest series, compared to its previous run.

Superdrug’s brand presence on the Love Island app has also helped drive engagement with male customers, promoting in-store services and products. During the latest series, male traffic rose to account for 25% of visits generated from the app.

Its Love Island collaboration also featured heavily on social media, with the retailer posting exclusive content of the contestants, keeping its followers engaged.

Elsewhere, Superdrug uses its own app to promote relevant targeted offers through its Health & Beautycard loyalty scheme. The proportion of the retailer’s sales from members continues to increase, supported by benefits such as double points and member-only pricing deals.

However, Boots is better placed to provide more relevant offers for its customers. Through its loyalty scheme Advantage Card – regarded as one of the best in retail – Boots uses customer data to drive personalised discounts and bonus points based on purchasing history and segmented customer data.

Along with social media, editorial content is key when driving interest in the sector and is used by all. The Body Shop has exploited this to leverage its ethical status to attract an increasingly environmentally conscious customer base, through articles conveying knowledge, advice and tips on a variety of product ranges.

Ecommerce

Given how much demand in the sector is influenced by beauty trends and what others are using and buying, the extent of product recommendation capabilities online has not been fully realised by the sector. Only 36% of health and beauty retailers offer recommendations based on other customers’ purchases.

Personalised shopping is a core point of difference for many in the sector. The Hut Group uses repeat purchase data to understand the replenishment time of each product so that it can contact customers as a certain item they’ve purchased is about to run out, with a link to the product online that makes it easy for them to top up.

The sector has also done well to remove friction from the online journey. All but Birchbox offer search autocomplete and suggestions, while all of the health and beauty retailers assessed autocomplete the checkout process. Making search functions effective and fast is crucial given the intense competition in the sector.

However, retailers’ online offers lack the customer experience that shoppers find in store, particularly when it comes to trying out products. But there are advancements being made in this field. Digital capabilities, such as video tutorials, demonstrate the use and dexterity of products, giving customers a virtual idea of how they could be used and would feel on their skin.

Lush is winning in this. As well as offering explanatory information, product pages are supported by lucid video content showing the use and application of the item – offering a similar experience to the interactivity and excitement generated in its stores, where every product can be tried and tested.

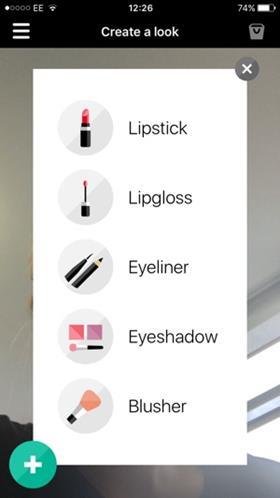

Elsewhere, Feelunique has developed its Makeup Live mobile app that allows customers to virtually try on products across a selection of brands by accessing the device’s camera.

Customer service and logistics

The fulfilment race has been as hotly contested in this sector as in others. All offer next-day delivery, except Birchbox due to its monthly subscription model, while all but Lush offer free delivery with a minimum order threshold.

Each retailer in the sector offers varying degrees of convenience. While Holland & Barrett offers both Saturday and Sunday delivery, Boots offers a level of guarantee through named-day delivery.

Elsewhere, fulfilment has been a key differentiator for Feelunique. In 2017, the etailer launched same-day evening delivery in London for orders placed before 11am. However, this comes at a substantial cost of £14.95 – more expensive than a high proportion of its products.

Space NK also offers same-day delivery in London for £12.

Health and beauty specialists are outperforming the retail industry as a whole when it comes to free returns, with 64% offering the option against 53% of all retailers assessed in Indicator’s study.

Retailers in the sector are also investing in live chat to bolster their customer service credentials.

Feelunique teamed up with Vivocha for its customer interaction platform, and has a team of beauty experts on hand to offer bespoke recommendations – such as matching a customer’s skin tone to a product – helping to eliminate barriers to purchase.

For customers less comfortable with online messaging, Feelunique also offers a call-back service at a time convenient for the customer.

Retail Week Indicator 2018 rankings

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

Currently reading

Currently readingRetail Week Indicator 2018: The innovators thriving in health and beauty retail

- 22

- 23

- 24

- 25

- 26